In this edition of our “Did You Know?” series, we look at how finance teams can verify foreign language expense receipts. This ongoing series highlights the capabilities and benefits of AppZen Expense Audit, bringing you deeper into what makes it tick and how you can take advantage.

Travel and expense managers and auditors in global companies need to ensure that expense policies are followed by employees traveling overseas in countries where English is not the native language. But spending decisions can be easily lost in translation when employees and auditors do not know how to read or speak the language.

Employees may not know what they're paying for in foreign countries

Employees traveling overseas tend to make decisions on local travel, meals, incidentals, and entertainment without fully knowing what service or product is being provided, or exactly how much it will cost. They may not always be aware of the latest foreign exchange rates, billing practices, or hidden fees and taxes that may be prevalent in a particular country.

Gaming the system when auditors can't read receipts

Further, employees who are looking for ways to game the policies may feel that finance managers and auditors based in their English-speaking headquarters may also not know how to read receipts in foreign languages. Thus, they may feel empowered to violate policies with respect to merchant categories, expense types, and amounts.

Google Translate isn't accurate enough for translating expenses

Expense managers and auditors have traditionally either ignored foreign travel receipts from an auditing standpoint or audited a small sample, perhaps 5%, of such receipts. They then try to use publicly-available tools, like Google Translate, which are often not accurate and are not integrated with their expense audit applications. This leads to lower confidence in identified risk areas, higher manual effort, and a lot of false positives.

Finance AI can extract and verify expense receipt data in 40+ languages

AppZen’s AI-powered Expense Audit specializes in reading unstructured data on receipts and enriches its understanding by using thousands of online and social databases. Only AppZen has the ability to extract unstructured receipt data in 40+ languages, use expense-specific proprietary translation technology to translate these into English, and then apply your corporate expense policies. It also detects and understands country-specific currencies and business documents. This enables finance auditors to identify expense violations by international employees or during foreign travel.

How AppZen finds out-of-policy expenses on foreign receipts

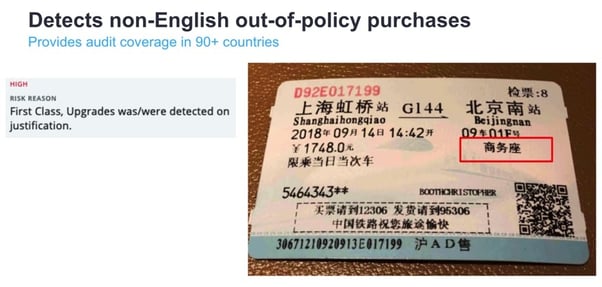

The example below illustrates how AppZen was able to detect a first-class airline upgrade by an employee in China.

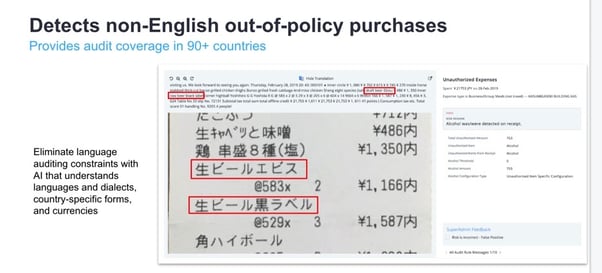

Another example below illustrates how AppZen automatically translates Chinese foreign language receipts into English, and overlays the translated text on top of the foreign receipt image, for ease of reference by the expense auditors.

Find missing or incorrect fapiao details

AppZen does more than translate and verify foreign language receipts against expense policy. When organizations have an operating entity in China, employees are required to submit fapiao receipts while submitting expenses, so businesses can qualify for tax deductions. AppZen’s fapiao validation model flags as high risk any relevant transactions with missing fapiao or incorrect fapiao details, so you can receive the deductions to which you are entitled.

Its powerful finance AI also checks for business titles and tax codes, vendor name consistency, fapiao format, and official stamps. It ensures all the proper fapiao are collected and ready to be used in the reclaim process. It allows expense managers to stay in compliance with fapiao requirements and maximize tax deductions on all qualifying expenses.

More than just a translator

Well beyond a translator, Expense Audit helps you avoid losing more than just the subtleties and significance of foreign expenses during your auditing process. It checks against policy and regulations to ensure your organization maintains compliance, saving time, money, and its valuable reputation.

Check out this handy Expense Compliance Assessment Tool to discover your compliance score and learn how to uncover hidden expense violations like missing or incorrect fapiao.