Card Audit

Audit cards

at the speed

of spend

Supercharge your corporate card expense program. Gain visibility and improve compliance with AI that audits 100% of card activity as purchases are posted.

Maximize card adoption with confidence

Audit 100% of card transactions with AI via seamless connections to all bank and card networks, rather than waiting for T&E management systems to process purchases and collect receipts. Investigate every dollar spent on your existing corporate cards – no need for new card programs.

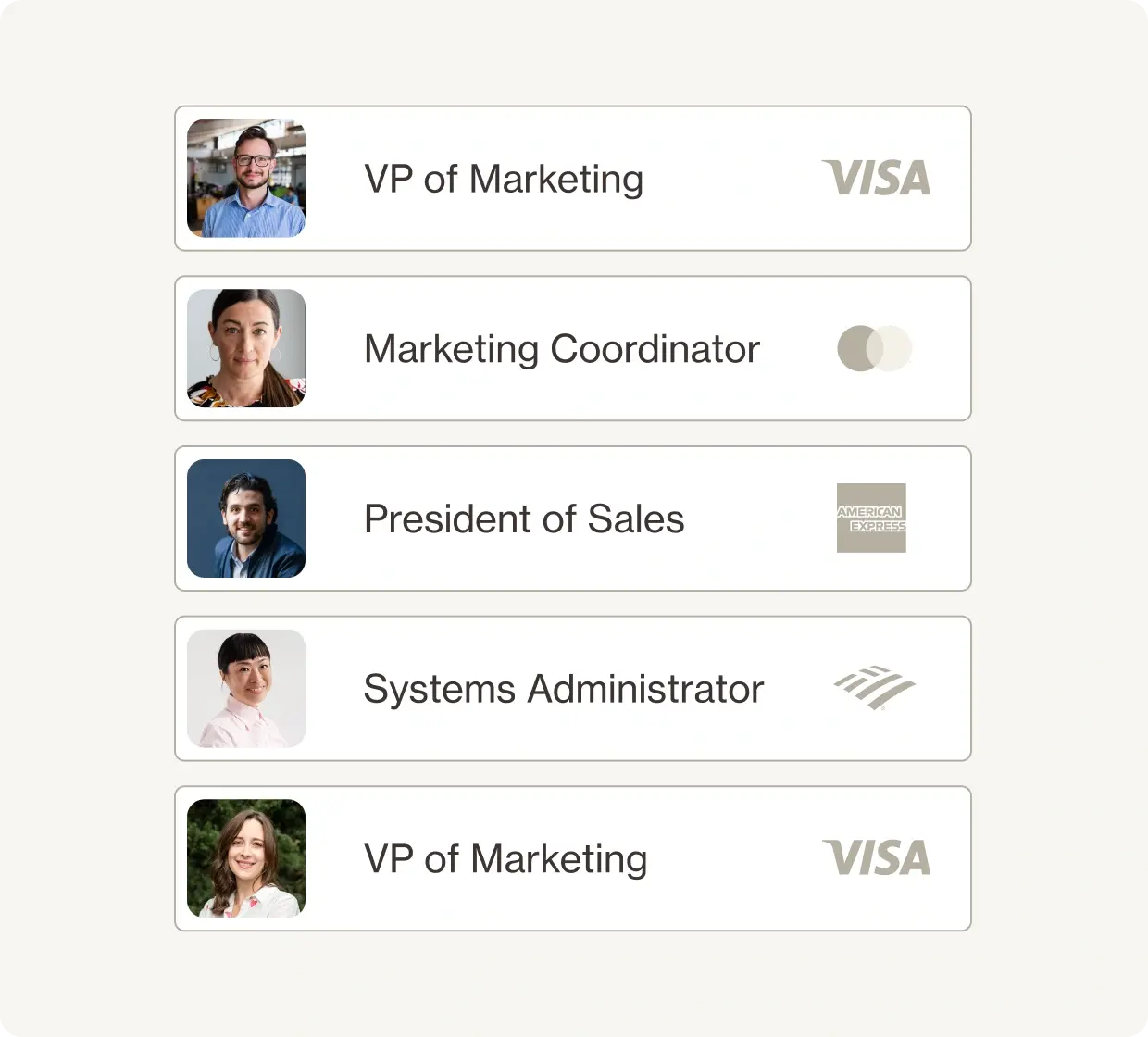

Gain visibility for corporate card expense management

Get a clear view that combines Level 2 and 3 card data, social and web resources, and learning from card transaction audits. Our AI proactively learns the spend context, recognizes typical spending patterns, and validates compliance using billions of audits and enriched card data.

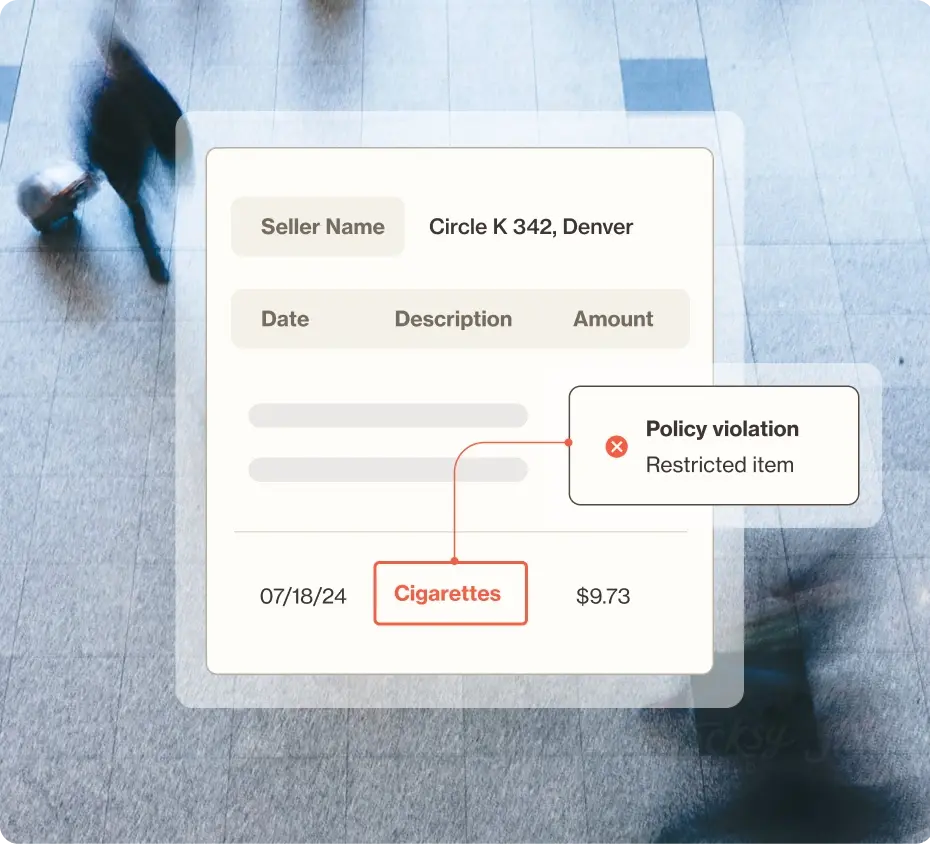

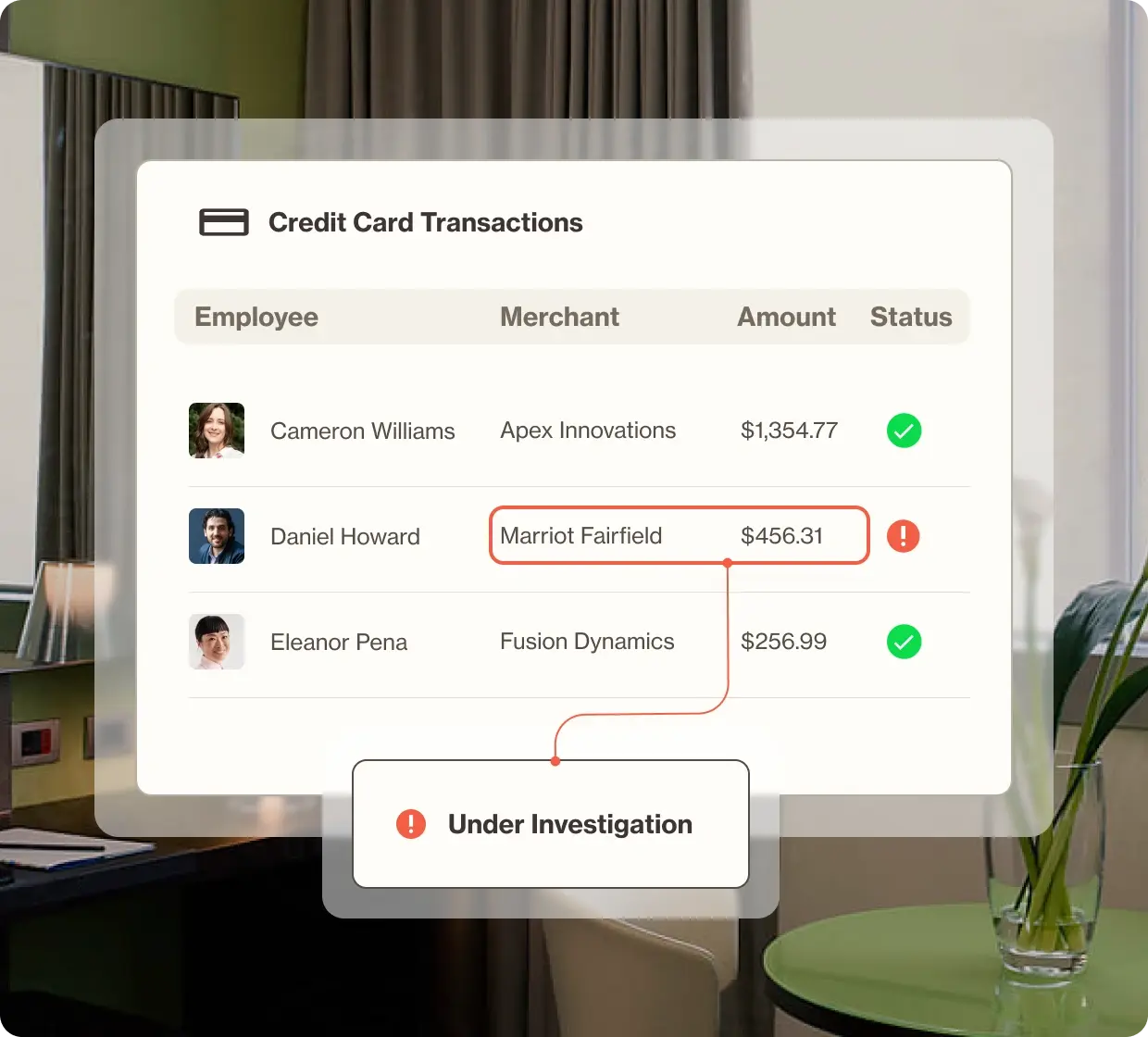

Track spending and investigate potential issues faster

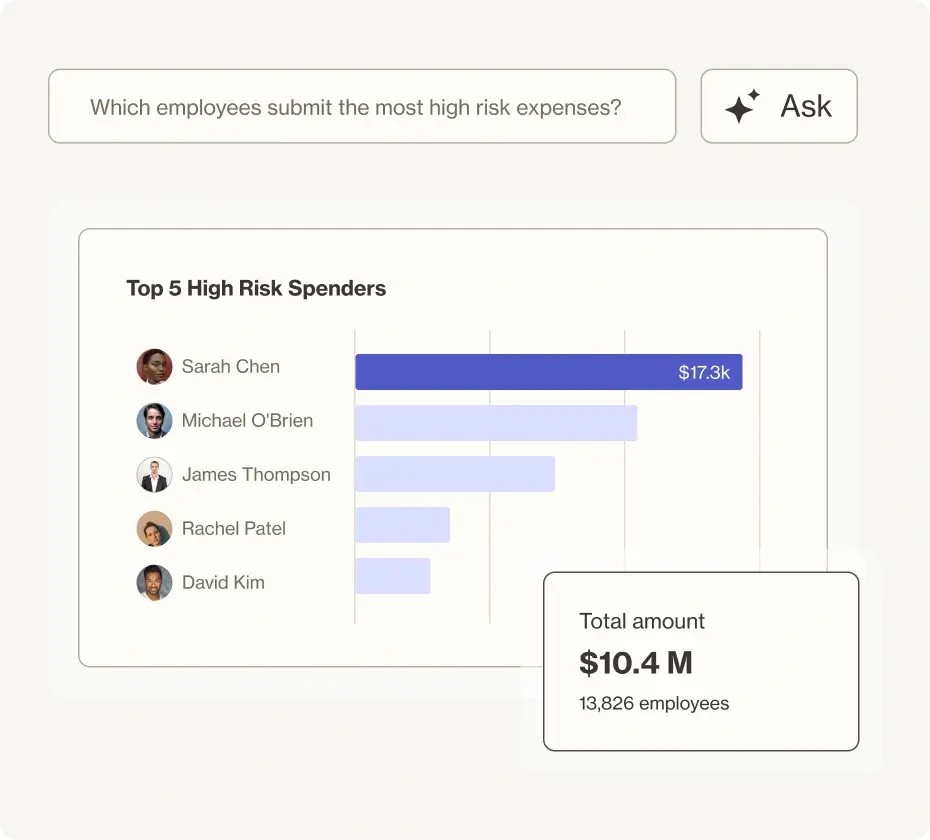

AI automatically flags policy violations, repeat violators, and potentially fraudulent card purchases. Identify spending that needs a deeper compliance review based on behaviors detected by AI across card transactions, expense reports, and invoices.

Tell your data’s story with AI Analytics

Get clear insights on card spending patterns, anomalies, and policy violations at a glance, to help you make data-driven decisions. Drill into transaction details with interactive visualizations and Level 3 data for corporate, purchasing, and ghost cards. Automate custom reports that deliver business insights and value for your organization.

Optimize your corporate card expense program with Mastermind

Customer stories

FAQs

01 What is corporate card expense management?

02 How does AppZen Card Audit help manage corporate credit card receipts?

03 What does AppZen Card Audit do?

04 Can AppZen Card Audit work with our existing corporate card expense management program and bank relationships?

Yes, AppZen Card Audit connects to all major banks and card networks, requiring no changes to your existing card programs or banking relationships. This allows you to maintain your current card setup while gaining enhanced visibility and control.

05 What types of fraud and policy violations can AppZen Card Audit detect?

AppZen Card Audit detects duplicate charges, unauthorized purchases, out-of-policy spending, and suspicious patterns across all card transactions and expense reports. We also flag potential fraud by identifying anomalous behaviors and repeat offenders.

06 How does AppZen Card Audit’s AI technology differ from traditional expense management systems?

Unlike traditional systems that rely on basic rule-based checks, AppZen Card Audit uses advanced AI to understand context, analyze patterns, and learn from billions of previous audits. The system can read receipt images, understand Level 3 card data, and detect subtle patterns that basic automation misses.

07 How does AppZen Card Audit help manage corporate credit card receipts?

AppZen Card Audit’s AI technology reads and analyzes receipt images in real-time, automatically extracting key information like merchant details, amounts, and line items without manual intervention. Even when receipts are missing, the system leverages Level 3 card data to provide detailed transaction insights, helping finance teams maintain compliance while reducing the burden of receipt management.

08 What reporting and analytics capabilities does AppZen Card Audit offer?

AppZen Card Audit provides interactive dashboards and customizable reports that show spending patterns, policy compliance rates, and potential savings opportunities across all card programs. Finance teams can drill down into detailed transaction data and create reports tailored to their organization’s specific needs.

Request a Demo

Ready to rethink what’s possible for your finance team?

AppZen is changing how businesses control card spend and budgeting.